Living in America presents many opportunities, but hidden costs can catch you off guard. This list explores the unexpected expenses that can impact your budget so you’re better prepared. Here are the 19 hidden costs of living in America that you may not have realized.

Student Loan Debt

Higher education comes with a hefty price tag, and student loans can be a significant financial burden long after graduation. Monthly payments can strain finances, and interest rates and repayment terms make it even worse. According to SmartAsset, student loan debt in the U.S. adds up to almost $2 trillion.

Housing Costs

Rent and mortgage payments consume a large portion of many budgets, too, with hidden costs including property taxes, homeowner’s insurance, and maintenance fees. Additionally, fluctuating housing markets can impact affordability and stability, making it harder to predict long-term expenses and secure stable housing.

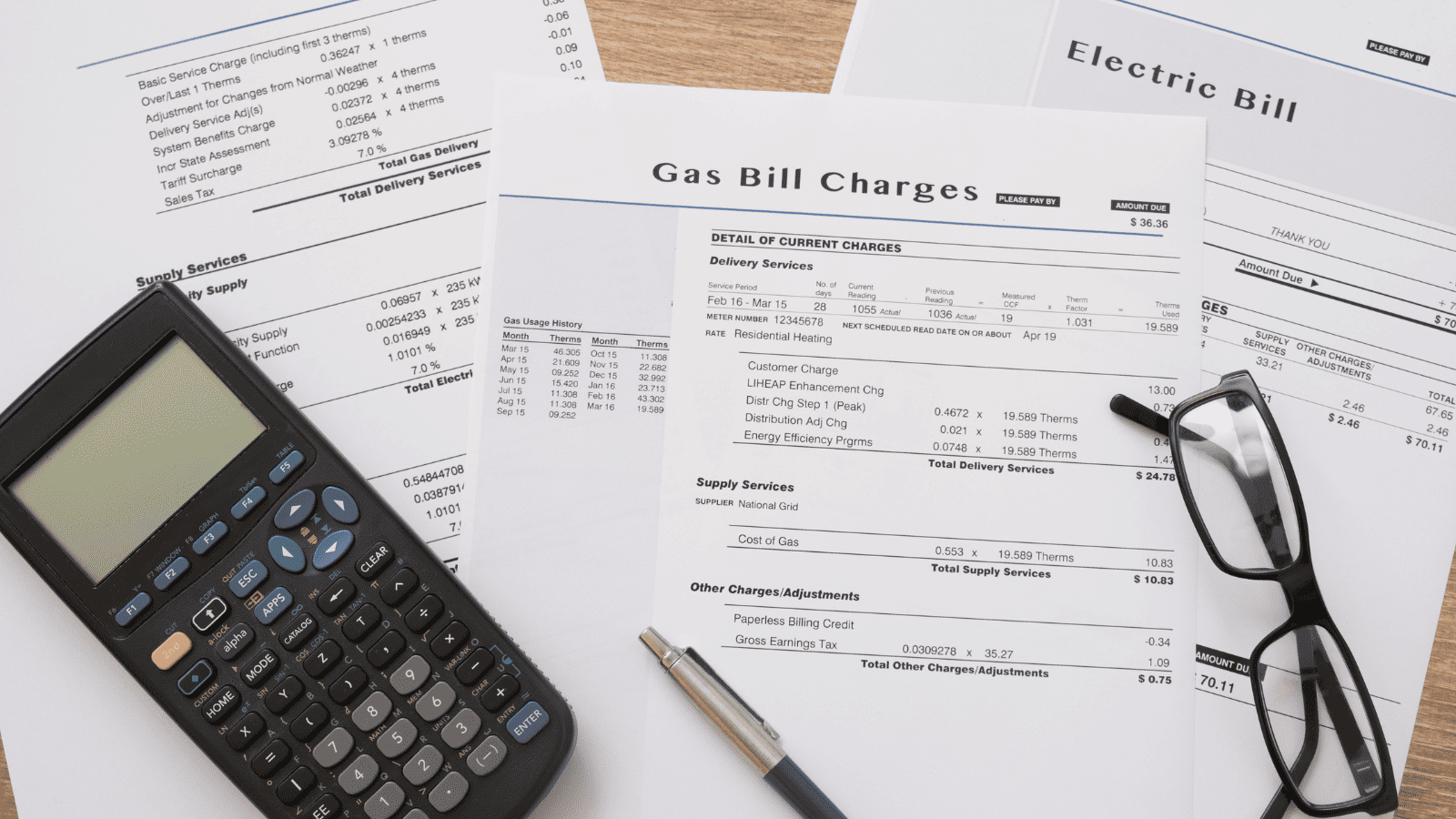

Utility Bills

Utilities often surprise us by exceeding initial expectations. Electricity, water, heating, and cooling costs can fluctuate a lot depending on the season and how much you use. Then, there are those hidden costs like service fees, repairs, and energy-efficient upgrades that can really do a number on finances over time.

Childcare Fees

Daycare centers, nannies, and after-school programs aren’t cheap, and their costs can vary a lot depending on where you live and the quality you’re looking for. This can put quite a strain on finances, making it tough to budget for other essentials when you have young kids.

Transportation Expenses

Owning a car involves more than just the purchase price; you have to think about maintenance, repairs, insurance, and fuel costs. Public transportation, while often cheaper, may also come with hidden costs such as time lost in commuting and occasional fare increases, all of which costs more than expected.

Healthcare Expenses

Healthcare in America is notoriously expensive; even with insurance, things like deductibles, co-pays, and out-of-pocket maximums can add up fast. Regular doctor visits, prescription meds, and emergency care all pile on these hidden costs, making it tough to predict and manage your healthcare budget.

Insurance Premiums

Insurance is essential, but premiums can be surprisingly high for things like auto, home, health, and life insurance costs. They can also fluctuate based on numerous factors, including age, location, and risk levels. Understanding these premiums and budgeting for them is crucial to avoid unexpected financial burdens.

Food and Grocery Prices

Food expenses can be all over the place. Grocery prices depend on where you live, what you eat, and what you like. Plus, eating out or ordering in just adds to the costs. It makes food one of those budget items that’s super variable and often underestimated, impacting your overall financial stability.

Subscription Services

Streaming services, gym memberships, and software subscriptions often seem minor individually but can collectively impact finances. Over time, these recurring costs can add up, creating a significant portion of a monthly budget that is easy to overlook while we’re watching our shows.

Entertainment and Leisure

Entertainment expenses can really pile on the debt; between movie tickets, concerts, sporting events, and hobbies, the costs can put a strain on your budget (and your fun). These activities are great, but they can get pricey fast if you’re not keeping an eye on them.

Personal Care and Grooming

Personal care products and grooming services are essential, but they can be pretty pricey. Haircuts, skincare, cosmetics—these things add up fast. Between regular upkeep and the occasional splurge on a luxury item, the costs can really sneak up on you.

Home Maintenance

Owning a home includes numerous upkeep costs, but the worst part is the unexpected. This can include issues such as plumbing or roofing problems, and can significantly impact a budget, making homeownership more costly than initially anticipated for many people.

Pet Care Costs

Pets are beloved family members but come with expenses like veterinary bills, pet food, grooming, and boarding costs, to say the least, and they can all put a significant dent in your monthly budget . Additionally, unexpected medical emergencies for pets can result in substantial expenses – as well as heartache.

Education and Extracurricular Activities

Kids’ education and extracurriculars often come with a price tag. School supplies, uniforms, sports gear, and lessons all add up to the hidden costs of raising children. These expenses can pile up quickly, affecting a family’s budget and financial plans, and may compromise spare money for the family vacation.

Taxes and Fees

Various taxes and fees are a part of everyday life, but that isn’t to say they can’t greatly impact the cost of living in America. Sales tax, income tax, property tax, and service fees are all things to consider. Understanding and planning for these costs is essential to managing your money.

Clothing and Apparel

Clothing is a regular expense that can be surprisingly high. Seasonal changes, fashion trends, and the need for work-appropriate attire contribute to ongoing costs. Additionally, quality clothing often comes with a higher price tag, making it a significant hidden cost for many of us.

Health and Wellness

Staying healthy and well is super important, but it can get pricey. Gym memberships, fitness classes, health supplements, and wellness treatments all add up. These costs are essential for our well-being, but they can quickly pile up and affect our overall budget and financial stability.

Emergency Savings

Unexpected emergencies such as car repairs or home emergencies can definitely strain finances, and other unforeseen expenses necessitate having a robust emergency fund. Building and maintaining this fund is a hidden cost that is crucial for financial security but often overlooked.

Technology and Gadgets

And lastly, keeping up with technology can really add up. New smartphones, laptops, software updates, and repairs can get pricey, but they’re essential. Staying current with tech is often a must, but it can definitely strain your budget. These hidden costs are a big deal in the digital age.

Up Next: 20 Personal Things You Should Never Share With Others

Building meaningful connections with others requires a certain level of transparency and trust, but that doesn’t mean you have to tell your friends and family members everything! Some aspects of our lives are too personal, incriminating, or risky to share. This article explores 20 aspects of your personal life that you should always keep confidential.

20 Personal Things You Should Never Share With Others

18 Things Everyone Forgets to Include in Their Will—But Shouldn’t

Wills and estate plans are essential ways to ensure what will happen to your belongings and property when you die or are incapacitated. However, people often forget to include important information in their wills before it’s too late, complicating matters for their descendants. Here are the 18 common things people forget to include in their will.

18 Things Everyone Forgets to Include in Their Will—But Shouldn’t

18 Items at Walmart that Aren’t Worth Your Hard-Earned Money

For many of us, Walmart is the go-to superstore. Whether we need groceries, clothing, or technology, Walmart is a one-stop shop for everything you would need. However, there are some Walmart products you should avoid at all costs, such as the following 18 examples.

18 ITEMS AT WALMART THAT AREN’T WORTH YOUR HARD-EARNED MONEY