Americans live in a consumer-driven society; no one can deny that. In all the chaos of trying to make more money, companies employ different tricks that many of us fall for almost every time. Today, we’ll expose 21 of these to always watch out for.

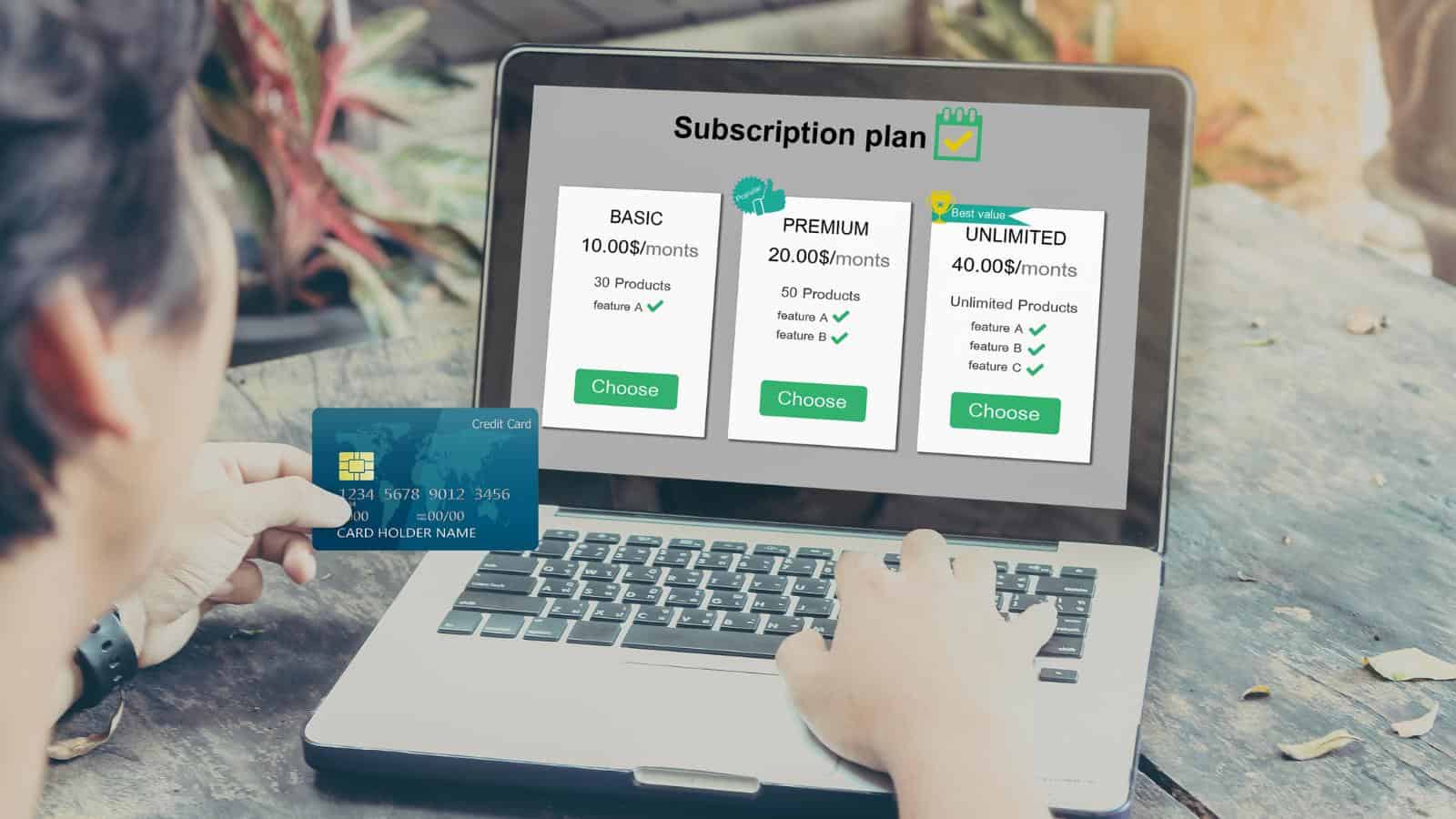

Subscription Services

Dubbed ‘dark patterns,’ subscription services use strategies to deceive or coerce users into making repeated purchases on their websites. An FTC audit shared by PC mag revealed that the most common tactic is making auto-renewals difficult to cancel, silently draining everyone’s bank accounts.

Loyalty Programs

As unbelievable as it may sound, loyalty programs are also used to trick you into parting with some money. How, you may ask? Well, they offer you rewards and discounts, but to access these, you typically have to spend more than you intended. You end up somewhat obligated to keep purchasing from the business, too.

Psychological Pricing

It’s fascinating how psychological pricing tricks people into spending more, too. Prices ending in .99, for example, make items seem cheaper than they are, and this tactic particularly exploits how we perceive value—making a $9.99 item appear significantly more affordable than $10.00. Barely anyone has the time to analyze how minimal the difference is.

Flash Sales

Flash sales may seem like the best way to enjoy discount offers on certain products. But what you may not know is that they’re sometimes used as advertising strategies. These sales create a sense of urgency and make you feel like you’re missing out on a great deal if you don’t make a purchase immediately—effectively pushing you into impulse buys.

Free Shipping Thresholds

It’s also easy to see how free shipping thresholds encourage additional spending. To avoid shipping fees, businesses require you to add more items to your cart to meet the minimum purchase requirement. Of course, you end up spending more than you initially intended, all for the sake of avoiding a shipping charge, which is sometimes minute.

In-Store Layouts

If you’ve ever walked into a store and felt compelled to buy more, it’s because certain store layouts are also designed to maximize spending. Essential items are placed at the back, forcing you to pass tempting products to get there, and this increases the likelihood of you picking up additional, unplanned items along the way.

Buy Now, Pay Later

Be careful when considering ‘buy now, pay later’ plans as well. Retailers often promote these plans to make purchases seem more affordable. However, these plans come with high interest rates and fees, which can lead to paying much more in the long run if not managed carefully.

Items at the Checkout Center

It’s worth noting that small add-ons at the checkout counter are also there to increase your total purchase. Items like candy, magazines, and travel-sized products are strategically placed to encourage last-minute impulse buys. They may seem like insignificant purchases, but you best believe that they add up quickly and increase your overall spending over time.

Frequent Sales Events

Most people don’t realize how frequent sales events are designed to create a sense of urgency and constant cash flow. Regularly occurring sales like Black Friday, Cyber Monday, and holiday promotions encourage continuous spending throughout the year, making it difficult to distinguish between true deals and marketing ploys.

Bundle Deals

Interestingly enough, bundle deals can trick you into spending more by offering a discount on multiple items. While the deal might seem beneficial, you often end up buying products you don’t need. Retailers use this tactic to increase the average transaction value, effectively boosting their overall sales.

Personalized Advertising

Ever noticed how ads seem tailored just for you? Personalized advertising uses your browsing history and personal data to show products you’re more likely to buy. Targeted approaches like these have been proven time and time again to tempt you into making purchases, especially if they’re coupled with other ‘discount’ tricks.

Scarcity Tactics

What may be more common knowledge, however, is that scarcity tactics, like ‘only a few left in stock,’ are used as psychological tricks to pressure you into making a purchase quickly. They create a fear of missing out, and the perceived rarity of the item allows the business to even sell it to you for a higher price.

Cashback Offers

Interestingly, cashback offers can trick you into spending more by giving the illusion of savings. Yes, earning cashback on purchases might seem like a good deal. But these offers often encourage unnecessary spending, as the promise of getting money back can lead you to buy items you wouldn’t normally consider.

Influencer Endorsements

If you’ve been to social media platforms, you’ve likely seen influencer endorsements as well. To break it to you, many of them aren’t genuine. Influencers are only paid to promote products by creating a sense of trust and authenticity. Their recommendations can make you more inclined to buy, often without realizing the influence of their paid partnerships.

High-Pressure Sales Tactics

High-pressure sales tactics are another favorite tool of salespeople. They use persuasive language and aggressive follow-up calls or texts to remain on your mind and close promising deals quickly. What they hope for, sometimes, is that these tactics overwhelm you and force you into hasty decisions that you’ll most likely regret, too.

Comparison Pricing

There’s no denying that comparison pricing can be misleading as well. Retailers display high original prices next to discounted ones to make deals seem better. This tactic makes the discounted price appear more attractive, encouraging you to buy, even if the ‘original’ price was inflated or never actually charged.

Emotional Appeals

Ever heard of emotional appeals in advertising? Marketers use emotional triggers to connect with you on a personal level. Ads that evoke happiness, nostalgia, or even guilt can influence your buying decisions, and these emotional connections specifically make you more likely to purchase products that promise to fulfill those feelings.

Limited Edition Products

Interestingly enough, limited edition products are also for you to spend by creating a sense of exclusivity and urgency. Specifically, the fear of missing out on a unique item can push you to buy quickly, and what’s even more dubious is that these products are also often priced higher than other items around.

Extended Warranties

Often unnecessary and expensive, extended warranties are also part of another strategy employed by retailers. Retailers push these warranties to the forefront when you purchase expensive products, preying on your fear of potential future costs. However, most of the time, you probably don’t even need them or don’t get back as much as you spend maintaining them.

BOGO Offers

You may be surprised to find out that BOGO (Buy One, Get One) offers are also often used to force you into overspending. While getting an extra item for free seems like the best deal in the world, these offers often encourage you to buy items you don’t even need. The allure of getting something ‘free’ can also justify inflating your initial purchase amount.

Time-Limited Memberships

It’s worth noting that time-limited memberships also make you spend unnecessarily by creating a sense of urgency to join. Gyms, clubs, and subscription services offer discounts for signing up quickly, pressuring you to commit without fully considering the long-term costs. Eventually, you’re stuck with memberships with recurring expenses that add up over time.

Up Next: 20 Seriously Stunning Natural Wonders Across America

Geological wonders, diverse ecosystems, and impressive waterfalls—the U.S. is home to a huge range of breathtaking landscapes and natural wonders across its many national parks and attractions. Head to these 20 locations for true natural beauty and never-ending adventure opportunities.

20 Seriously Stunning Natural Wonders Across America

17 Places That Undercover Cops Will Always Monitor

While it isn’t always obvious, undercover cops play a crucial role in maintaining public safety. They blend into the background in various locations, carefully observing and acting to prevent crime. In this article, we’ll reveal 17 places where you’re likely to find undercover cops—though you can bet you won’t see them!

17 Places That Undercover Cops Will Always Monitor

17 Things You’re Just Too Old To Be Doing Anymore

The older you get, the more fragile you are physically and mentally, so it’s important to prioritize your well-being every day. Whether you still feel young at 50 or are closer to 80, we’ve compiled 17 things you’re too old to be doing anymore.