Managing finances in this modern age can be extremely difficult thanks to automatic billing renewals and different subscriptions that all add up. Limiting your spending as much as possible can save you a surprising amount of money. Here are 20 ways that you can easily reduce your unnecessary expenses.

Cancel Unnecessary Subscriptions

Going through all your subscriptions and being brutally honest about what you need to keep can help you save money. You might even have subscriptions you completely forgot about. If you want to keep certain subscriptions, like streaming services, choose the cheapest option.

Cook at Home More Often

Healthline explains that restaurant meals can often have unhealthy ingredients, and takeouts aren’t any better. Thanks to the potential for batch cooking, freezing, meal planning, and more strict food budgeting, a lot of money can be saved on groceries.

Use Public Transportation

If you’re open to selling your car, alternative modes of transport can save you a hefty sum on gas and car maintenance. Calculate how much it would cost compared to using public transport or a bicycle. Ride-sharing is also a money-friendly alternative.

Always Shop with a List

To avoid one of the biggest money traps – impulse spending – you’ll always want to make a strict list before you go shopping. Make sure to stick to the list and buy only what’s necessary. Making a list also helps you budget so you know how much you can comfortably spend.

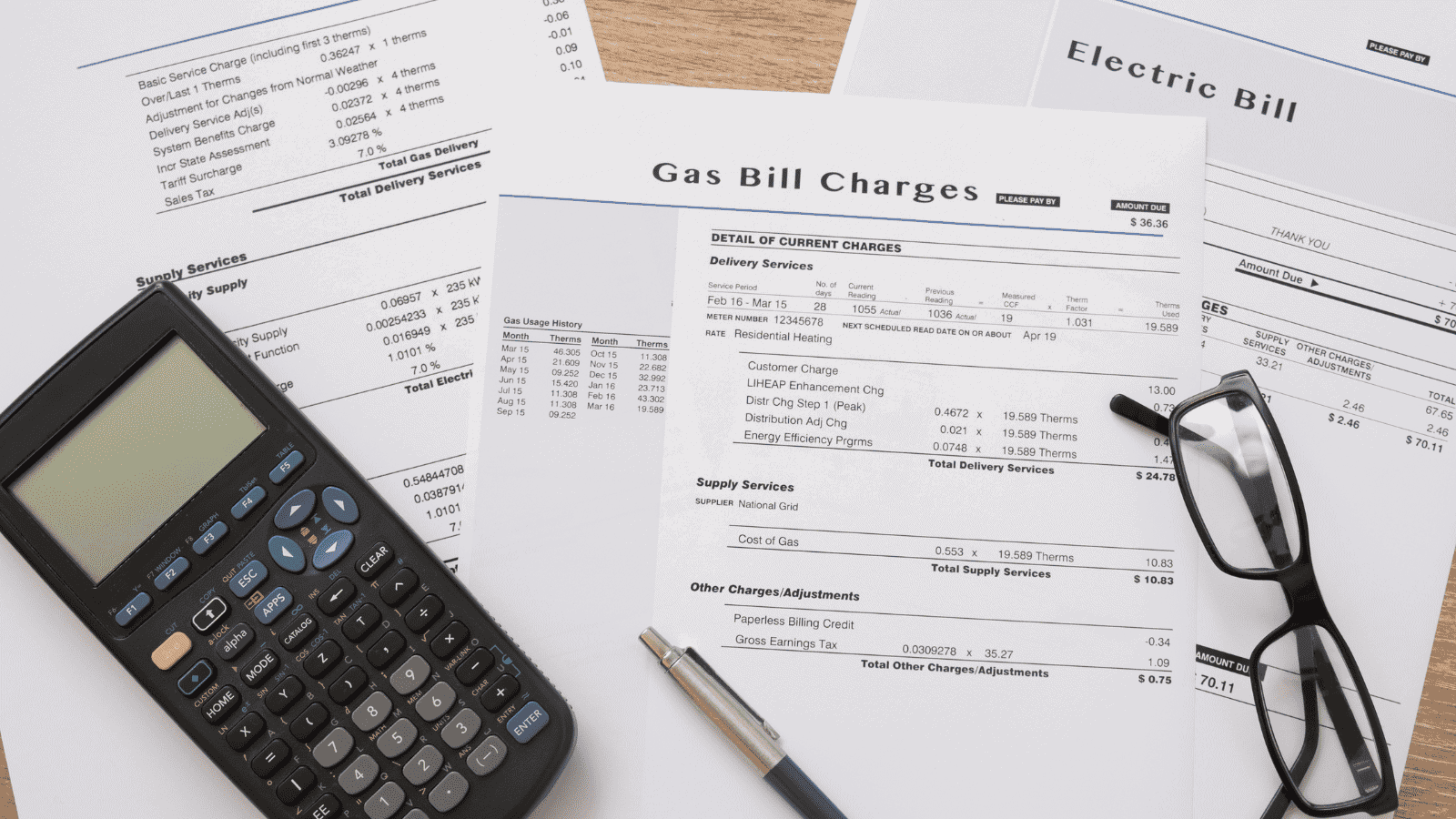

Reduce Utility Bills

There are many easy ways to cut the price of your utility bills. These include switching to energy-saving electronics, light bulbs, and programmable thermostats so you don’t spend a fortune on heating. Regular maintenance checks on utility systems also mean you can catch problems early and avoid wasting money.

Cut Out Cable TV

If it’s a choice between cable TV or streaming services, you might want to choose the latter. Streaming services are more customizable and can be easily canceled at any time. You can also share streaming accounts with friends and family to split the bill between everyone.

Reduce Clothing Expenses

According to CNBC, shopping at thrift stores can save you an average of $1,760 a year. Try shopping only during sales or off-season to grab the same clothing items for a cheaper price. Opt for items that go with many of the clothes already in your wardrobe, which can be worn for many different occasions.

Avoid Bank Fees

Bank fees can easily rack up without you noticing, so choosing a bank that offers free savings and services can help you save money. Be more careful with ATMs that charge for withdrawals or foreign transaction fees on certain services.

Look for Restaurant Deals and Happy Hours

If you don’t want to restrict yourself too much and still want to eat out regularly, try looking for restaurant deals or the cheapest dining hours. You should also set a monthly budget for dining out so that you know when you’re reaching your limit (and avoid that dessert)!

Opt for DIY Home Repairs

Do it yourself to avoid the extra cost of hiring a professional to complete a simple home repair. Watch online tutorials for easy DIY jobs and invest in a basic toolkit so that you can take care of any household issues yourself—without the high service price tag.

Buy Generic Brands

Try out a store brand instead of your usual name brand and compare quality – often, you’ll find it’s the same. Especially with household items like cleaning products, you can get the same standard from a generic bottle. You could even make your own all-purpose cleaner with baking soda and vinegar, says Good Housekeeping.

Utilize Cashback and Reward Programs

Don’t forget about signing up for cashback and reward programs for credit cards you always use anyway, as well as stores you’ll always shop at. You might as well be earning rewards as you go! The easiest way to keep track of loyalty programs is through apps.

Cancel Your Gym Membership

If you never go to the gym, your gym membership is costly and should be canceled. You can find free home workouts or cheaper at-home fitness equipment. If you want to remain social with exercise, there are many lower-cost options with sports clubs or fitness classes instead.

Switch to a Cheaper Cell Phone Plan

Regularly check your cell phone plan to understand whether you’re paying for unnecessary features or data. Opt for a lower-cost plan that provides the basic version of what you need. Alternatively, consider avoiding contracts altogether if possible.

Reduce Those Coffee Shop Visits

Grabbing your favorite takeout latte from the coffee shop on the corner on your way to work is easy, but you’ll be shocked at how much coffee shop visits can add up. Invest in a dependable, reusable coffee cup and make it yourself before leaving home.

Limit Your Online Shopping

The best way to avoid the temptation of too much online shopping is to cancel any email subscriptions that notify you about products. If something is non-essential, practice patience and see if you still want it a week down the line.

Simplify Your Personal Care

The New York Post highlights recent research revealing that some women can spend a quarter of a million dollars on their beauty regime in their lifetime. To simplify your beauty routine, do what you can at home to avoid salon costs and choose basic products.

Shop Around for Insurance

Get the best deal and save money by comparing quotes from different providers on all your insurance needs. You can also save money by bundling car, home, and health insurance from one provider. Make sure to check automatic renewals, too, in case it’s cheaper to switch.

Travel Smarter

Plan to travel only during off-peak times to save money on airfare and accommodation. If you travel regularly, use a travel reward program to gain points towards discounted travel. Take your time with planning so you can research the best prices.

Find Free Entertainment

Being social can get extremely expensive, but that doesn’t mean there aren’t free options out there. Many community events and museums are free to attend, and books and DVDs can even be borrowed from the local library for free instead of purchased.

Up Next: Do You Know Your Rights? 17 Things You Don’t Have to Answer When Stopped by Police

The thought of getting stopped by the police is a nerve-wracking prospect for most people. It can be even worse if you’re not sure what you should and shouldn’t say, creating a sense of paranoia, anxiety, and confusion. If you’re worried about the potential for a confrontation with the cops, we’re here to help. This list covers 17 things you don’t have to answer when stopped by police officers.

Do You Know Your Rights? 17 Things You Don’t Have to Answer When Stopped by Police

18 Things That Say You Are Middle-Class and Not Rich

The difference between the rich and middle class can be confusing, but the two couldn’t be further from each other in reality. In this article, we look at 18 signs that someone is middle class but not at all rich or wealthy.

18 Things That Say You Are Middle-Class and Not Rich

18 Reasons You Feel Like You Don’t Belong Anywhere

Feeling like you don’t belong anywhere can feel incredibly isolating. We need companionship to keep us connected to the world, so if you’re struggling to form relationships and don’t feel that you don’t fit in, here are 18 reasons why that might be.