There are many things that drain almost every American’s wallet without many even noticing. We’ve compiled 21 of these hidden costs to be wary of and some ways to avoid them.

Bank Fees and Penalties

Banking fees silently chip away at our savings and have become almost unavoidable in every American’s financial life. Fortune lets us know that some of the most common of these include monthly maintenance, out-of-network ATMs, paper statements, and even insufficient fund fees. You’ll need to regularly review your account to avoid these stealthy charges that can accumulate over time.

Subscription Services

We also have many subscription services linked to our cards, serving as recurring costs that we get automatically debited for every month. These include payments for streaming services, work-related services, and even gym memberships. And like the Wall Street Journal shares, it’s even worse that most of these subscriptions are made for you to forget to cancel.

Healthcare Premiums and Copays

In addition to the premiums we all pay for health insurance, there are additional copays we’re charged that increase our financial burden further. This is especially true for people who find themselves paying hefty premiums to begin with, and these copays are particularly charged when visiting doctors or filling prescriptions for specialized treatments.

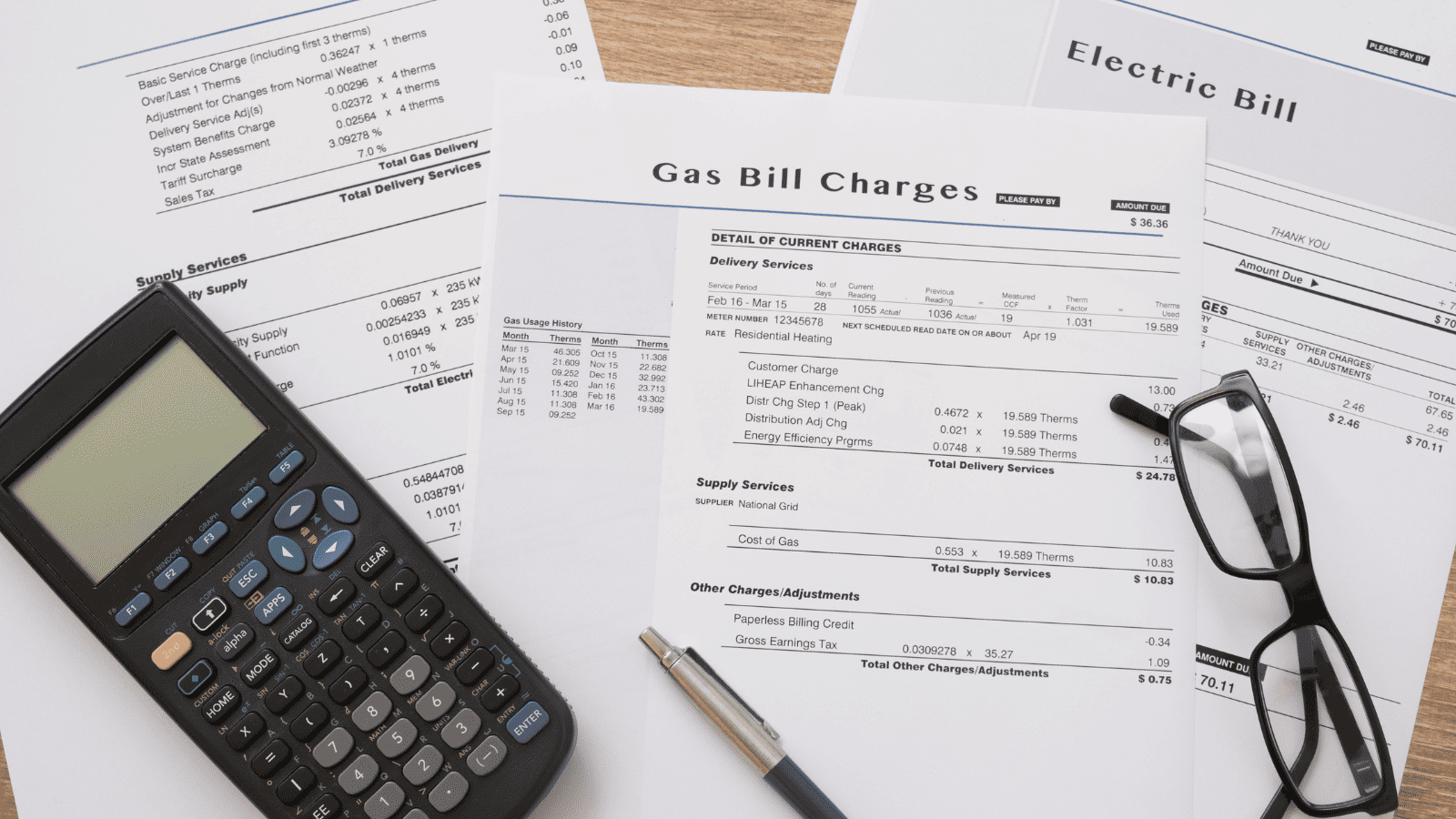

Utility Bills

Utility bills also often include hidden fees and surcharges that can significantly inflate your monthly expenses. Charges for things like energy efficiency programs or municipal services are frequently buried in the fine print, making it hard to notice. Scrutinizing your utility statements can reveal these extra costs, allowing you to budget more accurately.

Cell Phone Plans

Cell phone plans are notorious for hidden fees that can catch you by surprise. Whether activation charges or data overage fees, these costs can escalate quickly if you’re not careful. You can identify and eliminate unnecessary expenses that might be sneaking into your bill by reviewing your plan details and usage regularly.

Airline Fees

Air travel often comes with numerous hidden costs that have a big impact. Baggage fees, seat selection charges, and costs for in-flight services can make a seemingly affordable ticket much more expensive than you initially thought. Being aware of these potential add-ons can help you budget more accurately for your trips.

Car Insurance Extras

Car insurance policies may include hidden costs in the form of additional coverage options that you may not need. Roadside assistance, rental car reimbursement, and glass coverage are often snuck in without clear explanation or necessity. Reviewing your policy can help ensure you’re only paying for necessary coverage that suits your needs.

Rental Car Fees

Renting a car can come with a host of hidden fees that aren’t always obvious. Charges for insurance, additional drivers, and fuel can quickly inflate the cost, turning a good deal into a costly affair. It’s important to read the rental agreement thoroughly and ask questions about any unclear charges before committing.

Gym Memberships

Gym memberships can have hidden costs like initiation fees, annual maintenance charges, and penalties for canceling early. These extra expenses can make a seemingly affordable gym membership much more costly over time. Always read the contract carefully before signing up and understand all potential charges involved.

College Tuition and Fees

College expenses often extend beyond tuition, catching many students and their families off guard. Hidden costs can include lab fees, technology fees, and charges for extracurricular activities, and these can significantly increase the total cost. Prospective students and their families should thoroughly review the total cost of attendance to avoid surprises.

Home Maintenance

Owning a home involves hidden costs beyond the mortgage, which can add up quickly. Maintenance expenses for things like plumbing, roofing, and landscaping can become significant financial burdens if not anticipated. Hence, to help manage these financial demands more effectively, regularly setting aside funds for these inevitable repairs will help.

Childcare Costs

Childcare services often have hidden fees like registration fees, late pick-up penalties, and charges for special activities, which can increase the overall cost of care significantly. These sometimes go unnoticed initially, eventually adding to parents’ stress. Understanding all the fees involved can help parents better budget for childcare and avoid financial strain.

Credit Card Interest and Fees

CNBC also shares how credit card companies often impose hidden costs in the form of high interest rates and various fees. Late payment penalties, annual fees, and charges for exceeding your credit limit can add up quickly, especially if you carry a balance. Paying off balances in full each month can help avoid these financial traps and save money.

Hidden Taxes

Taxes on goods and services can sometimes be more than anticipated, impacting your budget. State and local taxes, as well as special district taxes, can significantly increase the final cost of purchases without much notice. Being aware of the total tax burden in your area can help you plan your spending more effectively.

Wedding Expenses

Weddings can come with numerous hidden costs that catch couples by surprise, too. Service charges, gratuities, and fees for things like cake cutting or corkage can add up quickly and inflate the budget. Couples should meticulously review contracts and ask about any additional fees to avoid budget overruns and stress.

Pet Ownership

Owning a pet involves hidden costs such as vet bills, grooming, and pet insurance, which can add up quickly. These expenses can accumulate, making pet ownership more expensive than initially anticipated, especially if your pet has health issues. Budgeting for these costs can ensure you’re financially prepared for comprehensive pet care.

Online Shopping Fees

Online shopping often includes hidden costs like shipping fees, handling charges, and return shipping costs. Business Insider also shares how businesses use partition and drip pricing strategies to make some of these fees even more hidden. These extra expenses can make online purchases more costly than buying in store, especially if you shop frequently.

Commuting Costs

Daily commuting can involve hidden expenses such as parking fees, tolls, and vehicle maintenance. These costs can add up significantly over time, affecting your overall budget more than expected. Considering alternative commuting options like public transportation might help reduce these expenses and save you money in the long run.

Retirement Account Fees

Retirement accounts, such as 401(k)s and IRAs, often have hidden fees for management and transactions that many overlook. These costs can erode your savings over time, impacting your retirement funds significantly. Regularly reviewing account statements and understanding the fee structure can help minimize these expenses and preserve your savings.

Owning a Business

Entrepreneurs can face hidden costs in business ownership, such as licensing fees, insurance, and compliance costs. These expenses can significantly impact profitability and overall financial health. To manage these hidden costs effectively and ensure business success, it’ll help to have a detailed financial plan and a regular review of business expenses.

Moving

Moving to a new home involves hidden expenses like the cost of packing materials, moving insurance, and temporary storage that are often overlooked but can significantly inflate your moving budget. Cost planning and budgeting for these additional expenses can make your move smoother and less financially draining, or even allow you to decide what services will help you spend less.

Up Next: 19 Completely False Things About America That Foreigners Think Are True

The U.S. is arguably the most famous country in the world, and people from far-off places often know our flag and president’s name! However, a lot of media coverage and exported movies mean plenty of opportunities for misunderstanding and stereotyping. Here are 19 false assumptions non-Americans often make about ‘the land of the free!’

19 Completely False Things About America That Foreigners Think Are True

20 Loyal Dog Breeds That Will Never Leave Your Side

Since early humans first fed a wolf around a campfire, dogs have been our constant companions and are renowned for making strong bonds with their owners. But which specific types of dogs make the most loyal and devoted pets? This article describes the 20 most unwaveringly loyal canine breeds and the characteristics that make them the ultimate ‘ride or die’ pets!

20 Loyal Dog Breeds That Will Never Leave Your Side

18 Reasons Older Men Say ‘Nope’ To Relationships

Older men embrace being alone and generally prefer spending time in solitude. They’ve had a full, so don’t criticize them for being less social! The following 18 reasons explain why older men prefer to be alone and are redefining how they experience their retirement years.