Getting past tax season can be quite a headache, and with all the stress you have to go through, it’s easy to make mistakes. We’ve compiled 19 common mistakes we see people make and provide you with what to do instead.

Missing the Filing Deadline

Filing your taxes late and missing deadlines due to this can attract hefty fines and interest charges. According to CNBC, you’ll be forced to pay 5% of your balance every month after the deadline, and of course, this increases your financial burden further. Yes, extensions are available, but it’s always best to organize your paperwork and make payments on time.

Incorrect Social Security Numbers

As the IRS shares, one of the main reasons many people see their tax return applications rejected is that they provided the wrong social security number (SSN). Thankfully, you can make corrections electronically, but you still have to deal with longer, frustrating waits for your refund. Always double-check your information and that of your dependents before submitting.

Forgetting to Sign Your Return

Your tax return will be considered invalid if it’s unsigned, and this puts you under more stressful and frustrating waits for a refund. Hence, whether electronically or physically (on paper), always make sure your applications are signed. Know that if you’re going for the electronic option, you’ll need an IP PIN from the IRS to append your signature.

Misreporting Income

Underreporting or overreporting income can trigger an audit or penalties, making tax season more stressful and costly. Inconsistent reporting can also harm your financial credibility, and this is another reason why you should always keep reports precise. Accurate record-keeping throughout the year simplifies this process and helps avoid discrepancies.

Ignoring Tax Credits

Tax credits can significantly reduce your tax bill, but they’re often overlooked. Missing these credits for education, energy-efficient home improvements, and childcare, for instance, leads to higher payments and missed savings. To avoid this and maximize your savings, research available credits thoroughly and ensure you apply for those you qualify for.

Claiming Ineligible Dependents

Only eligible dependents can be claimed on your tax return, and incorrect claims can lead to audits and penalties and disqualify you from receiving certain credits. Avoiding this mistake ensures you don’t face unexpected tax issues. So, verify that each dependent meets the IRS criteria, such as relationship, age, and residency requirements.

Overlooking Tax Deductions

Many taxpayers miss out on valuable deductions, such as student loan interest expenses, that can reduce their taxable income significantly. If you don’t want to be one of them, always review IRS guidelines and consider using tax software or consulting a professional to identify all possible deductions for which you qualify.

Failing to Report All Income

All income must be reported, including side gigs and freelance work, which can be easily overlooked. Use Form 1099-MISC or other relevant forms to report additional income accurately. Unreported income may lead to an IRS audit, which CBS says will involve an analysis of your bank deposits and business, among others. And you face a 20% penalty on unpaid taxes.

Incorrectly Calculating Estimated Taxes

Self-employed individuals and freelancers must pay estimated taxes quarterly, but miscalculating these payments can result in underpayment penalties. Use the IRS Form 1040-ES and consult a tax professional to accurately estimate your taxes. This helps you avoid unexpected bills at the end of the year and stay compliant.

Neglecting to Adjust Withholding

Failing to adjust your withholding after major life changes can lead to owing money at tax time or receiving a smaller refund. Incorrect withholding can disrupt your financial planning too. Hence, always review and update your W-4 form when you experience events like marriage, divorce, or having a child to ensure proper withholding and avoid surprises.

Not Keeping Accurate Records

Poor record-keeping can cause you to miss deductions and credits. You want to always keep organized records of all income, expenses, and receipts throughout the year to ensure accurate reporting and maximize your tax benefits. This habit can also simplify the tax preparation process and reduce errors.

Missing Out on Retirement Contributions

Contributions to retirement accounts like IRAs and 401(k)s can reduce your taxable income significantly, offering long-term benefits. Take advantage of these contributions to lower your tax bill while saving for the future. Ensure you meet the deadlines for contributions to optimize your tax strategy.

Failing to Report Foreign Accounts

The IRS requires reporting of foreign bank accounts exceeding $10,000, but many overlook this obligation. And they do this despite the fact that failing to do so can have severe legal consequences. You should use the Report of Foreign Bank and Financial Accounts (FBAR) to disclose these accounts, ensuring compliance and avoiding hefty fines.

Overlooking State Taxes

State tax requirements vary and can be complex, but missing state tax obligations can lead to fines and additional interest, compounding your tax issues. Neglecting state taxes can also affect your credit score. So, it’s important to ensure you understand your state’s tax laws and file state tax returns if required.

Not Seeking Professional Help

Tax laws are complex and frequently change, making it difficult to stay updated. Professional advice ensures you maximize deductions and credits while remaining compliant with IRS regulations. CNN advises that consulting one is particularly crucial when you run a business, invest in unconventional markets like cryptocurrency, or get an inheritance.

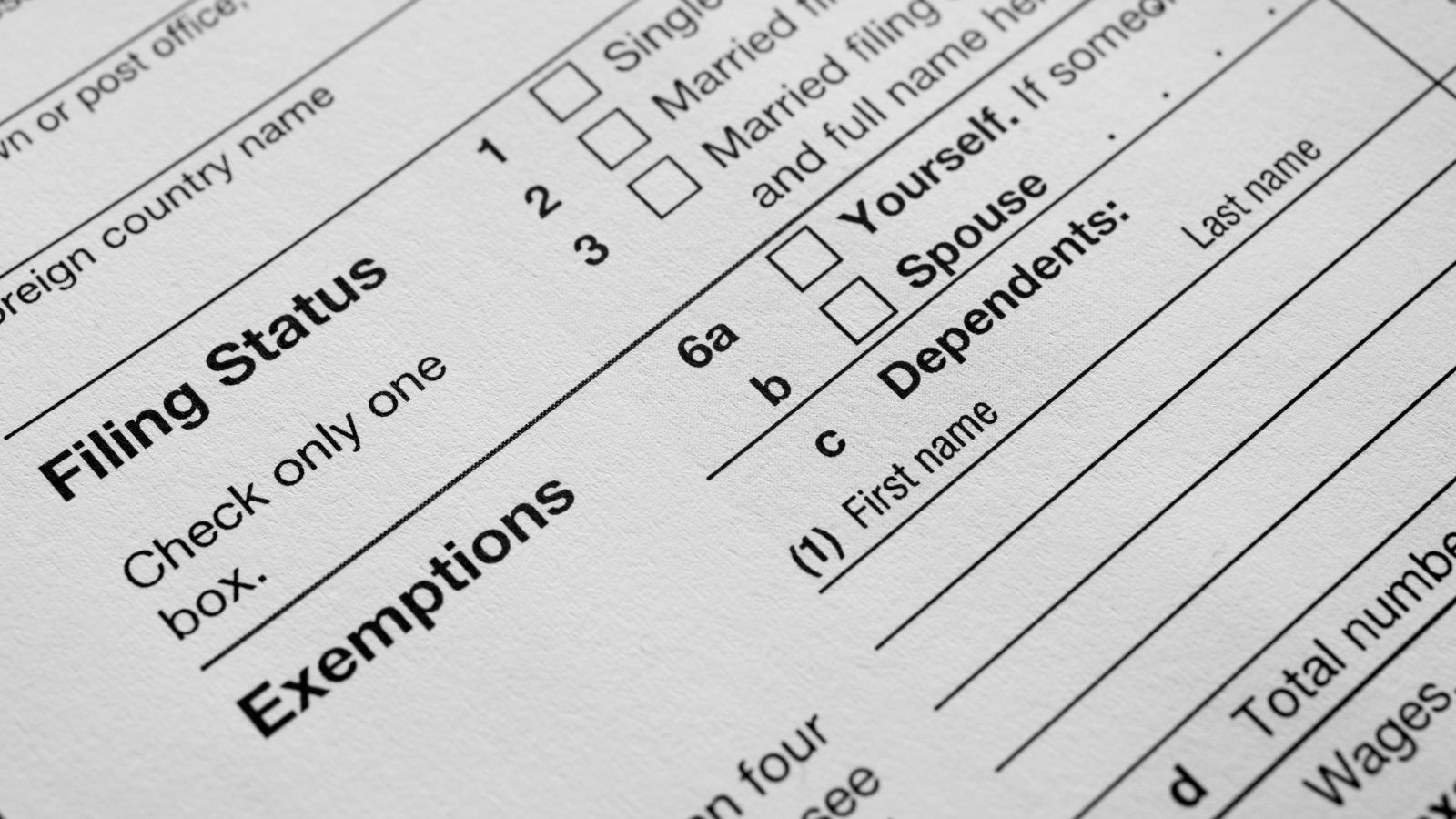

Incorrect Filing Status

Choosing the wrong filing status can affect your tax rate and eligibility for certain credits, potentially costing you money. To avoid this, review the IRS definitions for each status and select the one that best applies to your situation. Also, consult a professional if unsure to avoid making costly mistakes.

Not Claiming Medical Expenses

Many taxpayers overlook deductible medical expenses that can provide significant tax relief as well, and this results in a higher taxable income. Medical expenses exceeding a certain percentage of your income may be deductible, so it’s also helpful to keep detailed records of your out-of-pocket medical costs, including prescriptions and doctor visits.

Ignoring Home Office Deductions

Self-employed individuals can deduct home office expenses, but this deduction is often missed by them. To significantly reduce your taxable income and help you maximize your deductions, ensure your home office meets IRS requirements. You should also keep records of any related expenses and actually consider these deductions when filing your taxes.

Misunderstanding Business Expenses

Also, it’s important to note that while self-employed individuals can deduct business expenses, not all expenses qualify under IRS rules. For instance, capital expenses and certain insurance payments don’t qualify for deductions. Hence, you should understand what constitutes a deductible business expense and keep thorough records of these too.

Up Next: 19 Things You Didn’t Realize Are Against The Law

Most laws are common sense, like those involving theft, property damage, or violence, but there are many lesser-known regulations that most people aren’t even aware of. This article reveals 19 illegal acts that may inadvertently turn you into a common criminal. Remember, ignorance of the law is no excuse for breaking it!

19 Things You Didn’t Realize Are Against The Law

18 Most Common Reasons Why Women Leave Their Husbands

All women have different preferences when it comes to their relationships and marriages. However, there are many universal behaviors, traits, and habits that commonly drive them to divorce. This list unveils the 18 most common reasons why women leave their husbands.

18 Most Common Reasons Why Women Leave Their Husbands

17 Behaviors That Make People Think Less of You

If you want to be accepted by those around you, you have to behave in certain ways. Obviously, you should still be yourself, but there are certain social ‘rules’ people should abide by, like avoiding these 17 behaviors that make people think less of you.