Credit cards are convenient means of payment that allow you to buy things even when you don’t have money with you. However, you may get too comfortable doing this and push yourself into some bad debt. To keep your finances healthy, here are 19 things you should try not to charge on your card.

Medical Bills

We all know how expensive healthcare is in the U.S., so it’s no surprise how overwhelming medical bills can be when charged to your credit card. As Experian says, you should explore other options, like working out payment plans, before reaching for your card. And, for your credit score, it’s better for you to have medical debt than credit card debt.

Rent or Mortgage

Financial advisor Maggie Germano, talking to U.S. News, explains that it’s too much of a financial strain to pay your rent or mortgage with a credit card. Understand that you’ll end up paying interest alongside your already-high rent, and with mortgages, you end up paying alongside mortgage interest too. Always pay these off with money specifically saved for them.

Taxes

Paying your taxes with your credit card is most likely to result in a high-value, high-interest debt. There are already IRS installment plans in place to make repayments more affordable, and you should utilize these options whenever you can. What’s more, some companies even charge additional fees for paying taxes with their credit cards.

Cash Advances

Cash advances from a credit card come with high fees and interest rates, and these costs can accumulate quickly, leading to difficulty in repaying the balance. Instead, look into alternative sources for emergency funds, such as personal loans or savings. Exploring community assistance programs can also be a viable option in times of need.

Student Loans

Typically, student loans offer lower interest rates and more flexible repayment options. It’s wiser to utilize these benefits instead of transferring the balance to a high-interest credit card. As using a credit card can also negatively impact your credit score, it’s also best to explore all other available repayment options for your student loans first.

Vacations

Vacations are already expensive, and interest charges on credit card balances can make your getaway significantly more costly in the long run. Instead, consider setting aside savings for your trip in advance. This way, with proper planning and budgeting, you can enjoy your vacation without financial stress.

Luxury Purchases

Luxury items can be tempting to charge to credit cards, but you should always consider potential long-term impacts before making impulsive purchases. Luxury items can lead to unnecessary (and significant) debt, and, as part of smart money management, you can easily avoid this by saving up for them.

Weddings

Weddings are costly events, and as interest on related charges accumulates quickly, it becomes harder to pay off your credit card balance. Consider setting a budget and saving in advance to cover wedding costs, and also explore alternative options like specialized wedding loans and DIY decorations to reduce your overall costs.

Gambling

When it comes to gambling, using your credit card can throw you into severe financial turmoil. Bankrate says, “You’re not just gambling your money but you’re also gambling with your credit score.” This is because you’re tempted to overspend and are likely to be dealing with uncontrollable interest charges and late fees that accumulate on your balance.

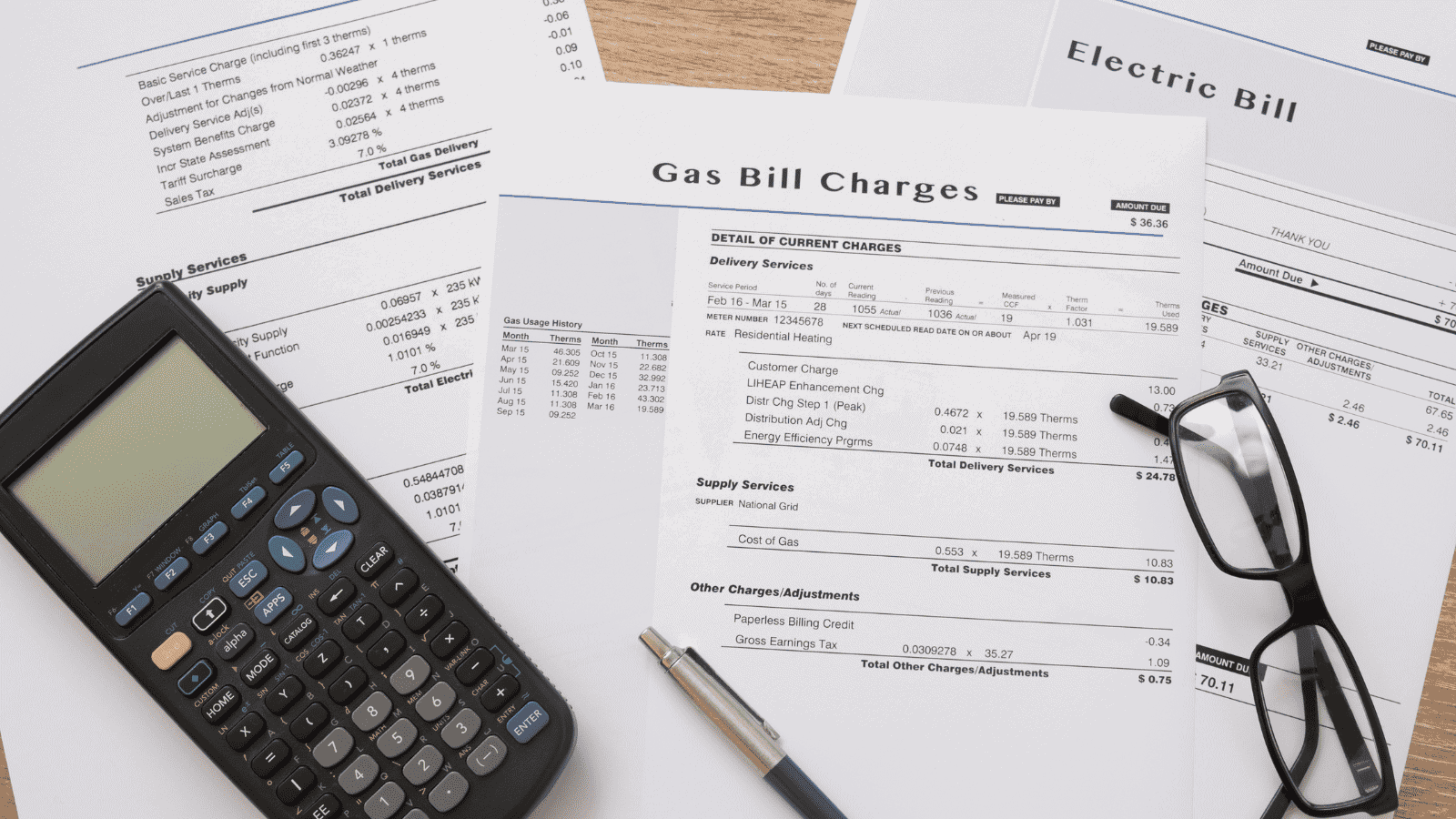

Utility Bills

Using a credit card for utility bills can lead to persistent debt, and interest charges, which inflate your monthly bills, also complicate payment management. Setting up automatic withdrawals from your checking account helps you to handle these expenses better, and for extra security, monitor your account regularly to prevent overdrafts.

Groceries

Charging groceries to a credit card can lead to revolving debt if you’re unable to pay off the balance each month, and interest charges will then add to the cost of these recurring purchases. Opting for a debit card or, better yet, carrying a measured amount of cash ensures you stay within your budget.

Car Repairs

Car repairs can be costly, and charging them to a credit card can lead to overwhelming high-interest debt. Instead, set up an emergency fund to specifically cover unexpected car repairs, which gives you added peace of mind for when an unfortunate situation with your car does occur.

Home Improvements

For home improvements, rather than using your credit card, opt for home equity loans or personal loans, which often have lower interest rates and more manageable repayment terms. Furthermore, planning a detailed budget can help avoid unexpected expenses, and comparing different financing options ensures the best deal for your project.

Business Expenses

Using a credit card for business expenses can complicate your finances. Forbes specifically shares that you shouldn’t charge business expenses on your personal credit card, as this doesn’t build your business’s credit or offer any more benefits. Use a business credit card or separate account to manage business expenses more effectively.

Car Payments

Why pay off car loans with a credit card when they already offer lower interest rates and fixed repayment terms? It’s wise to stick to your car loan agreement and avoid transferring the balance to a credit card, or to not even take up a car loan in the first place.

Concert Tickets

Concerts aren’t necessities, and tickets can be pricey, so it also isn’t wise to charge them to a credit card. Budget for these events in advance, and also opt to use cash or a debit card to avoid high interest charges. You’ll be glad to know that some venues might even offer discounts for early purchases or group bookings.

Membership Fees

Charging membership fees to a credit card will result in ongoing debt that you may not be able to easily get out of—worsened by the interest charges on these payments. Opt to pay for memberships up front or link them to a checking account to avoid accumulating debt.

Alcohol

Purchasing alcohol with a credit card will only push you into unnecessary debt, and paying with cash or a debit card helps avoid this pitfall. Moreover, setting a budget for alcohol can prevent overspending and unhealthy overindulgence, giving you peace of mind regarding your long-term financial and physical health.

Fast Food

Charging fast food to a credit card is particularly bad because of the hidden interest typically associated with such small, frequent purchases. These can build up to something significant over time. Instead, use cash or a debit card to pay for fast food and avoid paying more than necessary for your meals.

Up Next: 18 Reasons Why Men Get Grumpier As They Age

You might read this and be able to relate, or you may feel you’ve become grumpier the older you’ve gotten. Or maybe you know of a male friend or relative who has. Here are 18 reasons why men get grumpier as they age.

18 Reasons Why Men Get Grumpier As They Age

17 Products Millennials Refuse to Buy and It’s Affecting the Economy

Millennials have been the center of so much media attention due to their spending habits. Their unique ways of spending have built up and crushed many traditional industries. In this article, we look at 17 things millennials stopped buying and how that has impacted society.

17 Products Millennials Refuse to Buy and It’s Affecting the Economy

Where Even Truck Drivers Won’t Stop

Truck drivers tend to be hardy souls—well-seasoned travelers who aren’t often afraid to rest up or refuel in risky locations. However, there are certain U.S. locations that even the most road-weary trucker refuses to stop at for fear of criminal activity or natural dangers. Here are 17 such locations that even experienced truck drivers approach with trepidation (or not at all).